Источник:

https://sumitnarayanpotbhare.wordpre...t-transaction/

==============

Hi Guys, Hope you are keeping up with RetailDAXing. In my previous blog we have seen the

Expense transaction at POS. In this blog we are going to see the Income account functionality at POS and how it post to Trial balance. Income account transactions are done when we put cash into the cash drawer for a reason other than a sale like selling of piled up Daily newspaper, magazines, local community club uses the parking lot for car wash and provides you with payment etc.

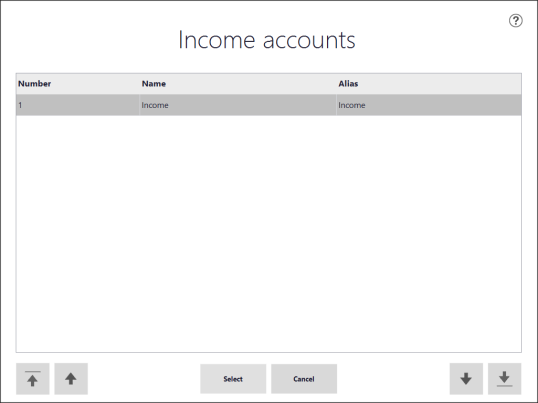

Setup Income accounts

To start with, we need to setup Income accounts on store card. There is no centralized setup for defining Income account because each store might want to reflect the postings in separate account.

- Go to Retail >> Common >> Retail Channels >> Retail Stores.

- Select the store and click Setup tab.

- Under Setup action pane >> Income/expense account.

Field

Description Account number Enter a unique identifier for the income account or expense account, such as “sales,” “COGS,” or “returns.”

Name Enter a name for the income account or expense account.

Search name A simple name that can help you find the income account or expense account when you search.

Account type Select

Income or

Expense to specify the type of account that you are setting up.

Ledger account Select the number of the general ledger account for the income account or expense account.

Name The name of the ledger account that you selected.

Setup Income account operation button on screen layout

- Once setup is done, run 1070 and 1090 scheduler job to replicate the setup to POS.

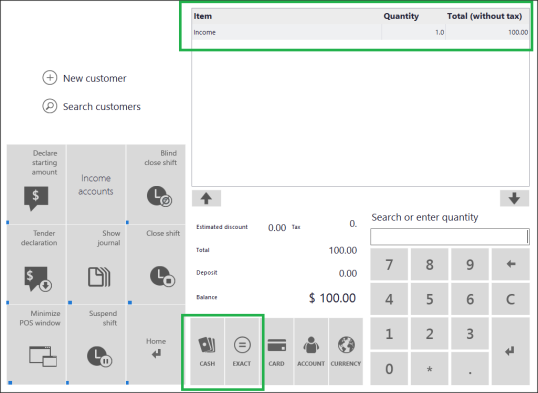

Operation at POS

Click on

Income account button.

Select from different

Income type setup on the store.

Enter the amount for the Income.

Now complete the transaction using the payment method that you receive the amount.

Run the

P-job to pull the transaction to DAX.

Statement posting & Trial Balance

Retail Store transaction inquiry

Income account transaction

Payment transaction

Now lets proceed for Statement posting.

So we have account number

112100 defined on the Cash account for the store Cash payment method and

401100 defined as Income account.

After Statement posting –

Feel free to reach out for any clarifications. If you like my blog posts then comment and subscribe to the blogs.

Please follow me on

Facebook |

Google+ |

Twitter | Skype (sumit0417)

Enjoy RetailDAXing.

Disclaimer: The information in the weblog is provided “AS IS”; with no warranties, and confers no rights. All blog entries and editorial comments are the opinions of the author.

Источник:

https://sumitnarayanpotbhare.wordpre...t-transaction/